Space startups funding halved in 2022 as investors shift to safer bets

Last year marked the toughest period for space startups since the economic crisis in 2008.

Investments in space startups more than halved to $21.9 billion in 2022 as their venture-capital backers sought safer avenues in the face of a grim economic outlook, VC firm Space Capital said, adding that it expects more pain for the sector this year.

Last year, which saw a sharp reversal from a record 2021 with $45.7 billion in funding, marked the toughest period for space startups since the economic crisis in 2008.

"As the economy recovered from the COVID pandemic, central banks unleashed the fastest rate hike cycle since 1988. Market momentum hit the brakes and asset prices fell across the board," Space Capital said in its quarterly report.

The difficult environment has prompted leading space companies to prioritize proven business models, revenue and government contracts, the report added.

"Companies that serve US government and defense needs are best positioned to maintain growth and profitability over the next year," Managing Partner Chad Anderson told Reuters.

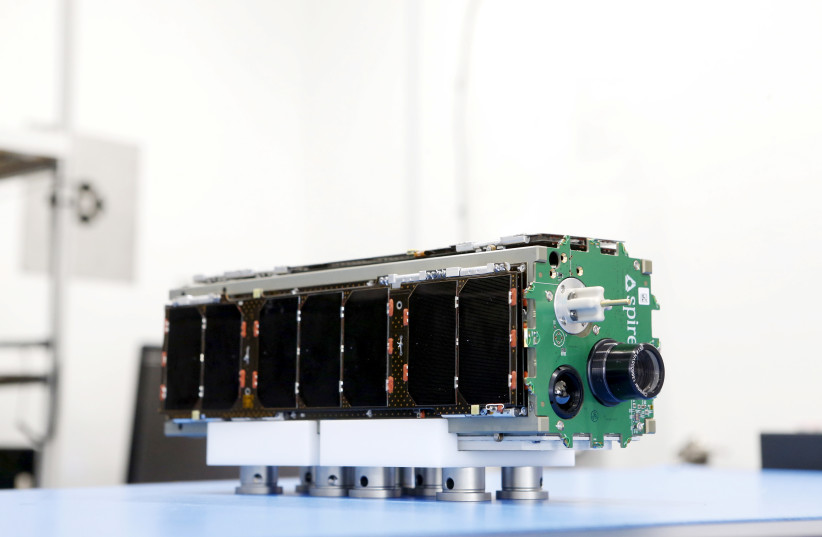

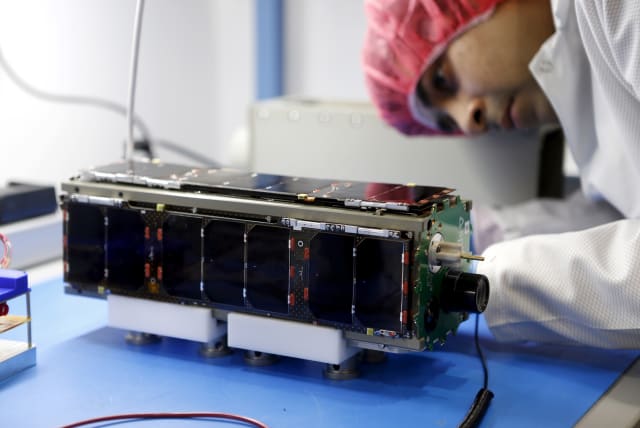

Satellite and data in the limelight

Lately, satellite-based analytics, imagery and data companies have come under the limelight, especially after Russia's invasion of Ukraine and Sino-US geopolitical tensions. For instance, private equity firm Advent International in December acquired satellite-imaging firm Maxar Technologies MAXR.N for $4 billion.

Private companies in the segment have also benefited, attracting total investments of $2.5 billion in the fourth quarter - nearly half the figure for the entire industry.

Startups developing hardware for space, however, have not been so lucky, as their capital-intensive business models discouraged investors, analysts said.

Still, such startups that are exposed to government contracts are seen as more resilient because they have access to a steady stream of income in the tough environment.

"There has been greater investor interest surrounding anything associated with government smallsat manufacturing, as it is generally viewed that the defense budget should be more recession-resilient," Canaccord Genuity analyst Austin Moeller said.

Jerusalem Post Store

`; document.getElementById("linkPremium").innerHTML = cont; var divWithLink = document.getElementById("premium-link"); if (divWithLink !== null && divWithLink !== 'undefined') { divWithLink.style.border = "solid 1px #cb0f3e"; divWithLink.style.textAlign = "center"; divWithLink.style.marginBottom = "15px"; divWithLink.style.marginTop = "15px"; divWithLink.style.width = "100%"; divWithLink.style.backgroundColor = "#122952"; divWithLink.style.color = "#ffffff"; divWithLink.style.lineHeight = "1.5"; } } (function (v, i) { });