SVB Financial seeks bankruptcy protection for reorganization

The move to seek bankruptcy protection comes after the company said on March 13 it was planning to explore strategic alternatives for its businesses.

SVB Financial Group said on Friday it filed for a court-supervised reorganization under Chapter 11 bankruptcy protection to seek buyers for its assets, days after its former unit Silicon Valley Bank was taken over by US regulators.

The move to seek bankruptcy protection comes after the company said on March 13 it was planning to explore strategic alternatives for its businesses.

Shares of big US banks fell more than 1.5% in premarket trading. Regional banks including PacWest Bancorp and First Republic Bank were down between 10% and 20%.

SVB Securities and SVB Capital's funds and general partner entities are not included in the Chapter 11 filing and the company said it planned to proceed with the process to evaluate alternatives for the businesses, as well its other assets and investments.

Reuters reported on Wednesday that the parent company was exploring seeking bankruptcy protection for selling assets.

What happened to Silicon Valley Bank?

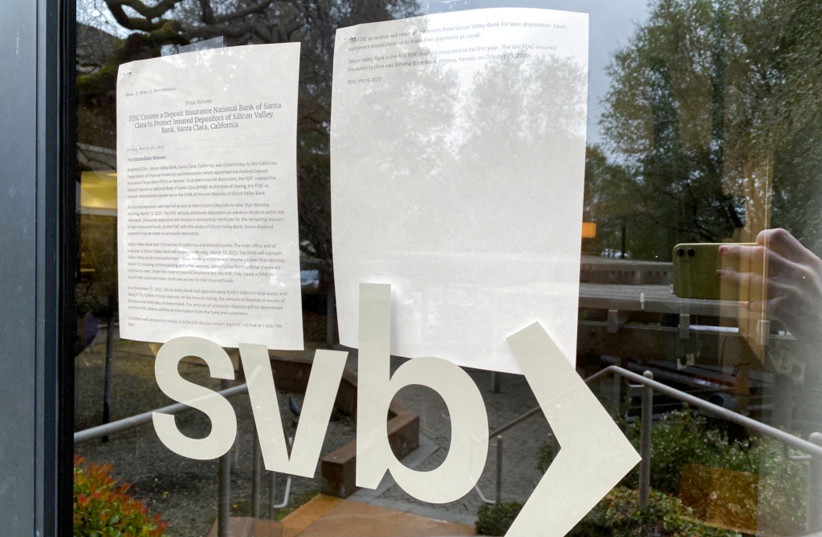

Californian regulators shuttered Silicon Valley Bank last Friday, making it the largest collapse since Washington Mutual went bust during the financial crisis of 2008.

The collapse crippled bank stocks and triggered concerns of a contagion throughout global markets.

The tech lender was forced to sell a portfolio of treasuries and mortgage-backed securities to Goldman Sachs at a $1.8 billion loss after a rise is yields eroded value. To plug that hole, it attempted to raise $2.25 billion in common equity and preferred convertible stock but spooked clients pulled deposits from the bank that led to $42 billion of outflows in a day.

The company said on Friday it has about $2.2 billion of liquidity. It had $209 billion in assets at the end of last year.

Jerusalem Post Store

`; document.getElementById("linkPremium").innerHTML = cont; var divWithLink = document.getElementById("premium-link"); if (divWithLink !== null && divWithLink !== 'undefined') { divWithLink.style.border = "solid 1px #cb0f3e"; divWithLink.style.textAlign = "center"; divWithLink.style.marginBottom = "15px"; divWithLink.style.marginTop = "15px"; divWithLink.style.width = "100%"; divWithLink.style.backgroundColor = "#122952"; divWithLink.style.color = "#ffffff"; divWithLink.style.lineHeight = "1.5"; } } (function (v, i) { });