Israeli stock market will recover like Israelites after the golden calf - opinion

Remember the famous investing principle of buying low and selling high. Investors who panic often end up selling low.

I was thinking of getting everyone depressed and writing a piece connecting Pessah cleaning to your finances as we are now under a month until the holiday, but I decided to focus on something more uplifting, the Golden Calf!

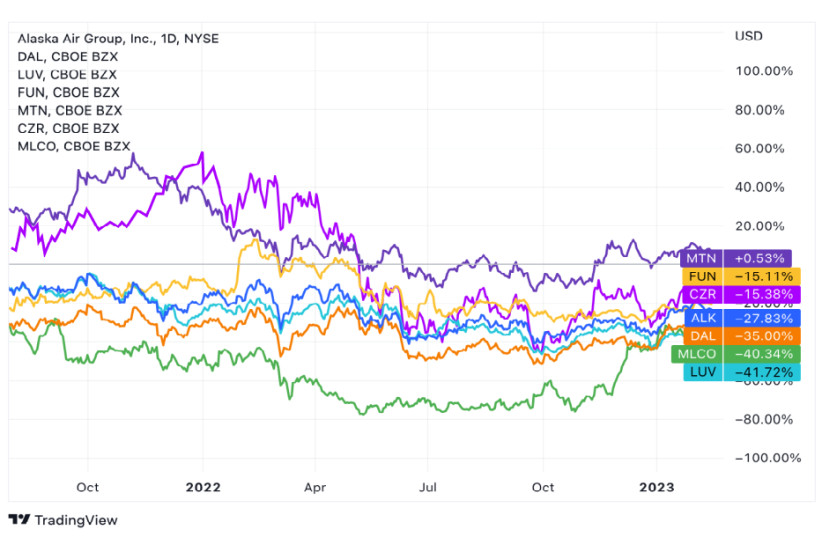

Will global inflation cool, or are higher prices and higher interest rates going to be with us for much longer than originally thought? Will continued rising interest rates end up cratering economies worldwide? When will the Russia/Ukraine war end? Will the local political chaos lead to economic turmoil? These questions and more have investors on edge, as global stock markets continue their losing ways. Keep in mind that we are now in month 15 of market losses.

This week we read Ki Tisa, the Torah portion dealing with the Golden Calf. Commentators have dealt with Aaron’s role in this episode and how he could’ve been responsible for building an idol.

Rabbi Baruch Epstein writes at Chabad.org, “Let us draw insight from one of the darkest moments in our history, the day the Golden Calf was created. It was the 16th of Tamuz. The Jewish people, less than six weeks since receiving the Torah at Sinai, panic at Moses’ apparent delay in returning from the mountain top.

Frustrated, a mob confronts Aaron and demands that he make for them a god. Hoping to deflate their zeal, Aaron instructs them to ask their wives for their jewelry for use in crafting their new deity. The Jews’ hotheadedness gets the better of their judgment and they eagerly offer up their own personal earrings and bracelets. Aaron, still hoping for his brother’s return and an end to the madness, stalls, declaring: “Tomorrow will be a celebration for G-d” (see Exodus 32).

The Midrash interprets this statement prophetically; indeed “tomorrow [the 17th of Tamuz] will be [in Moshiach’s time] a celebration for G-d.”

Speaking out

Imagine Aaron’s predicament. His holy nephew, Hur, was just stoned to death for his attempts to stop this mob. They are ready, willing and able to do the same to Aaron. His only option to save this gang of thugs from irreversible sin is to build them an idol. And in the midst of this chaos Aaron has the clarity to foresee and even proclaim: “tomorrow will be a ‘festival’ to G-d”!”

Investors are very nervous over the continued downturn in financial markets. While intellectually they understand that if they are investing for the long-term there are going to be market drops, emotionally no one likes losing money and a certain sense of anxiety takes over. If I can give one bit of advice, it’s: Don’t panic! Those who panic often end up making lousy decisions which turn out to be quite costly. That even includes those thinking of breaking their local pensions in order to move money abroad due to the local political situation (but that’s for another column).

optimism Now?

With the market continuing to drop, we may ask whether or not it is a good time to buy right now. Investors who go against the general market trend are called “contrarians.” A contrarian is also defined as an individual who believes that certain crowd behavior among investors can lead to exploitable mis-pricings in securities markets. For example, widespread pessimism about a stock can drive a price so low that it overstates the company’s risks and understates its prospects for returning to profitability. Identifying and purchasing such distressed stocks and selling them after the company recovers can lead to above-average gains. Conversely, widespread optimism, as we are witnessing in technology, can result in unjustifiably high valuations that will eventually lead to drops, when those high expectations don’t pan out. Avoiding investments in over-hyped investments reduces the risk of such drops.

It is important to remember that in widespread market drops, there are investment opportunities. Many good, profitable companies also drop significantly without any rational reason – in investing parlance that’s called throwing the baby out with the bathwater – and this could mean that now may be a good time to invest. Of course you need to do the research and weigh the risks versus the rewards.

Heed the call of Aaron and don’t panic. The future will be better. I know that it’s not easy but you need to relax and stay focused on your long-term goals. It’s important to remember that markets go up and down, and if you made a financial plan, it would have taken this type of market volatility into account. As I have written here many times, the worst thing you can do as an investor is panic and sell everything and then wait for the market to recover. The market tends to recover very quickly. Large market gains often come about in quick and unpredictable spurts, and missing just a few days of strong market returns can substantially erode long-term performance. Remember the famous investing principle of buying low and selling high. Investors who panic often end up selling low.

The information contained in this article reflects the opinion of the author and not necessarily the opinion of Portfolio Resources Group, Inc. or its affiliates.

Aaron Katsman is the author of Retirement GPS: How to Navigate Your Way to A Secure Financial Future with Global Investing. www.gpsinvestor.com; aaron@lighthousecapital.co.il.

Jerusalem Post Store

`; document.getElementById("linkPremium").innerHTML = cont; var divWithLink = document.getElementById("premium-link"); if (divWithLink !== null && divWithLink !== 'undefined') { divWithLink.style.border = "solid 1px #cb0f3e"; divWithLink.style.textAlign = "center"; divWithLink.style.marginBottom = "15px"; divWithLink.style.marginTop = "15px"; divWithLink.style.width = "100%"; divWithLink.style.backgroundColor = "#122952"; divWithLink.style.color = "#ffffff"; divWithLink.style.lineHeight = "1.5"; } } (function (v, i) { });